Lawsuit Loans

Get the financial support you need now A lawsuit loan is a form of financing provided to individuals involved in personal injury cases while they await their settlement. The loan is then repaid from the settlement or court decision, depending on the outcome of the case. These loans are non-recourse, meaning you owe nothing if your case fails.- No Credit Check

- Lowest Rate

- Get Cash In 48 Hours

- Repay $0 If You Lose

-

30 Reviews / 4.4 out of 5 stars

30 Reviews / 4.4 out of 5 stars -

335 Reviews / 4.4 out of 5 Stars

335 Reviews / 4.4 out of 5 Stars

Get a Structured Settlement Loan Now

From a Pre-settlement Funding LeaderWhat Our Customers Say

How Does A Lawsuit Loan Work?

Need cash while waiting for your lawsuit to settle? A lawsuit loan gives you a cash advance based on your expected settlement. When you apply, the lender reviews your case and its chances of success. If approved, you’ll receive funds upfront to cover expenses while your case proceeds. You only repay if you win, with repayment taken directly from your settlement.

In other words, lawsuit loans allow you to handle bills and cash flow issues while awaiting your legal outcome, without the risk of repayment if you lose. If your case could take months, or even years, can you really afford to wait without support?

-

1

Apply Online

Fill out a simple online form with your case details and contact information.

-

2

Case Evaluation

Our team evaluates your case in consultation with your attorney to assess the likelihood of success.

-

3

Receive Your Funds

Once approved, we’ll offer a portion of your expected settlement amount within 24 hours. Money will be sent directly to your bank account.

How to Qualify for a Lawsuit Loan

A lawsuit loan can be a financial lifeline, designed to support plaintiffs who are facing real hardship while waiting for justice. At Tribeca Lawsuit Loans, we make the process fast, fair, and focused on your needs.

To qualify for a lawsuit loan, you need:

- A lawyer representing you in the case

- Proof of an ongoing lawsuit or legal claim

- Have a personal injury-related lawsuit (Auto accidents, slip and fall, etc.)

- Be at least 18 years old

- A U.S. Citizenship or permanent residency

Do You Need Good Credit?

No. Lawsuit loans are not based on your credit score or employment history. Eligibility is based solely on the strength of your case.

Terms and Conditions

We believe in full transparency every step of the way. We’ll send a simplified loan terms sheet, shared with you and your attorney. You’ll also receive a detailed breakdown by email, and we’ll walk you through everything in a quick call to ensure clarity before proceeding.

How Long Do Lawsuit Loans Take?

Most lawsuit loans are approved and funded within 24 to 48 hours after your case is reviewed. Our process is designed to move quickly so you can get the support you need without delay.

Types of Cases Eligible for Lawsuit Loans

We believe financial pressure shouldn’t stand in the way of justice. Tribeca Lawsuit Loans offers pre-settlement funding across a broad spectrum of legal cases.

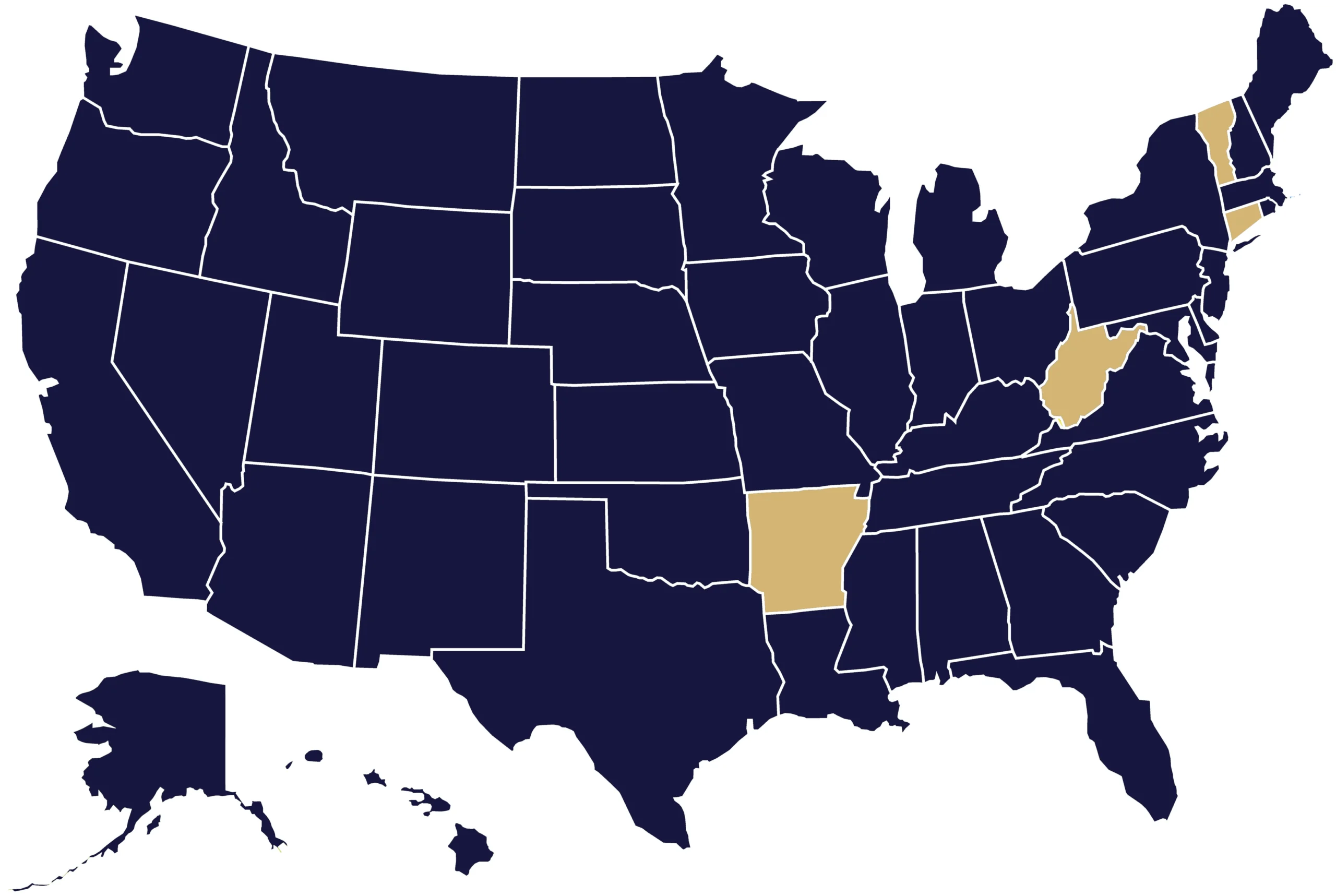

Other States That We Serve

- No Credit Check

- 24hr Funding

Lawsuit Loans vs Traditional Loans

The main difference between lawsuit loans and traditional loans is that lawsuit loans are non-recourse, so you don’t repay them unless you win your case. Traditional loans require repayment regardless of your situation and often rely on your credit history or employment status. So why take on financial risk when you don’t have to?

| Feature | Lawsuit Loan | Traditional Loan |

| Based on Credit / Income? | No | Yes |

| Non-Recourse | Yes | No |

| Approval Speed | Less than 48 hours | May take days or weeks |

| Use of Funds | Flexible; can be used for rent, medical bills, daily expenses, etc. | Varies; may be restricted |

| Risk Level to Borrower | Low; no repayment if you lose. | High; repayment required, no matter the outcome |

How to Choose the Best Lawsuit Loan Company For You

The right lawsuit loan provider can make a significant difference in both your experience and your financial outcome. The best companies are transparent, responsive, and committed to your best interests.

At Tribeca Lawsuit Loans, we stand by our mission and offer personalized support, competitive terms, and decades of experience to help plaintiffs bridge the financial gap while pursuing justice.

- Clear, simple terms with no hidden fees

- Non-recourse structure, so you only repay if you win

- Fast approvals and funding, often within 24 hours

- Direct communication with both you and your attorney

- Licensed and compliant with state regulations where required

Every case is unique, and we tailor our offer to your individual needs. This ensures that you get the best possible terms for your situation.

What to Expect if Your Lawsuit Settlement Falls Through

One of the biggest concerns when borrowing against a potential settlement is: What happens if I lose my case? With Tribeca Lawsuit Loans, the answer is simple. You owe us nothing.

Our loans are non-recourse, which means that if your case doesn’t settle or you don’t receive a court award, you keep the money we’ve advanced. There are no out-of-pocket costs, no debt collectors, and no stress over repayment.

We take the financial risk so you can focus on your recovery and legal process, not your bills. Because when you’re fighting for justice, the last thing you should worry about is how to afford it.

Ready to take the next step?

If you’re struggling financially while waiting for your case to settle, don’t wait another day. At Tribeca Lawsuit Loans, we’re here to put money in your hands fast and risk-free. Apply now and take back control of your financial future.

- No Credit Check

- 24hr Funding