New York Lawsuit Loans

Get Cash While Your Case SettlesIf you're a plaintiff in New York awaiting settlement from a lawsuit, lawsuit loans can provide the legal funding you need to make ends meet. Lawsuit funding is a non-recourse option that allows you to receive cash advances while your case is pending, with repayment only required if you win or settle. Getting lawsuit loans in New York is a risk-free solution to cover expenses during litigation.

- Repay $0 If You Lose

- Get Cash In 48 Hours

- Lowest Rate

- Repay $0 If You Lose

- No Credit Check

- 24hr Funding

Simple Steps to Get Your Lawsuit Loan in New York

The process of applying for legal funding through Tribeca is simple and fast. Our process is designed to help you get the support you need quickly while ensuring compliance with New York’s specific regulations.

-

1

Fill Out an Application

Just fill out the form and provide your case details. No credit check is required, which means you can apply without worrying about your credit history.

-

2

Review Your Case

Our team will review your case while working with your attorney to ensure everything is in line with local laws. Lawsuit loans require attorney notification in New York to ensure that the loan is approved by your attorney of record.

-

3

Get Approved & Funded

Once approved, we’ll send over your pre-settlement funding within 24 hours to cover medical bills, legal fees, or other essential costs without delay.

Overview of Lawsuit Settlement Loans in New York (NY)

Average Funding Per Case in New York

Varies by case type and strength, typically ranging from $1,000 to $2,000,000

Available Funding Amount in New York

$500 – $2,000,000

Fault Laws in New York

Pure Comparative Fault – Plaintiff’s negligence will offset the defendant’s liability

Statute of Limitations in New York

- Personal Injury: 3 years

- Medical Malpractice: 2 years & 6 months (but can be extended by the period of continuous treatment for the same condition)

- Wrongful Death: 2 years

New York minimum policy limits

$25,000 for bodily injury (per person)

Minimum UIM auto insurance limits in New York

- (BIL) $25,000 per person and $50,000 per accident;

- (PDL) $10,000 per accident;

- (PIP): $50,000 per person;

- (UIM) Coverage is optional in New York

5 Star Reviews

Apply for Low-Rate New York Lawsuit Loans!

Applying for a lawsuit loan through Tribeca offers benefits, including zero-risk repayment, where you only repay if you win or settle your case. With capped fees, your repayment is predictable, and our non-compounding rates ensure interest won’t accumulate over time.

Top Considerations for Selecting a Lawsuit Funding Company

Local Knowledge: With a deep understanding of New York laws and processes, our team will be able to provide the best financial solutions for you.

Transparent Terms: With Tribeca, there are no hidden fees or complex conditions, so you can make an informed decision.

Fast Processing: Our New York-based team can offer quick approval and legal funding to get you the support you need without delays.

Apply Today

"*" indicates required fields

Our Satisfied Customers

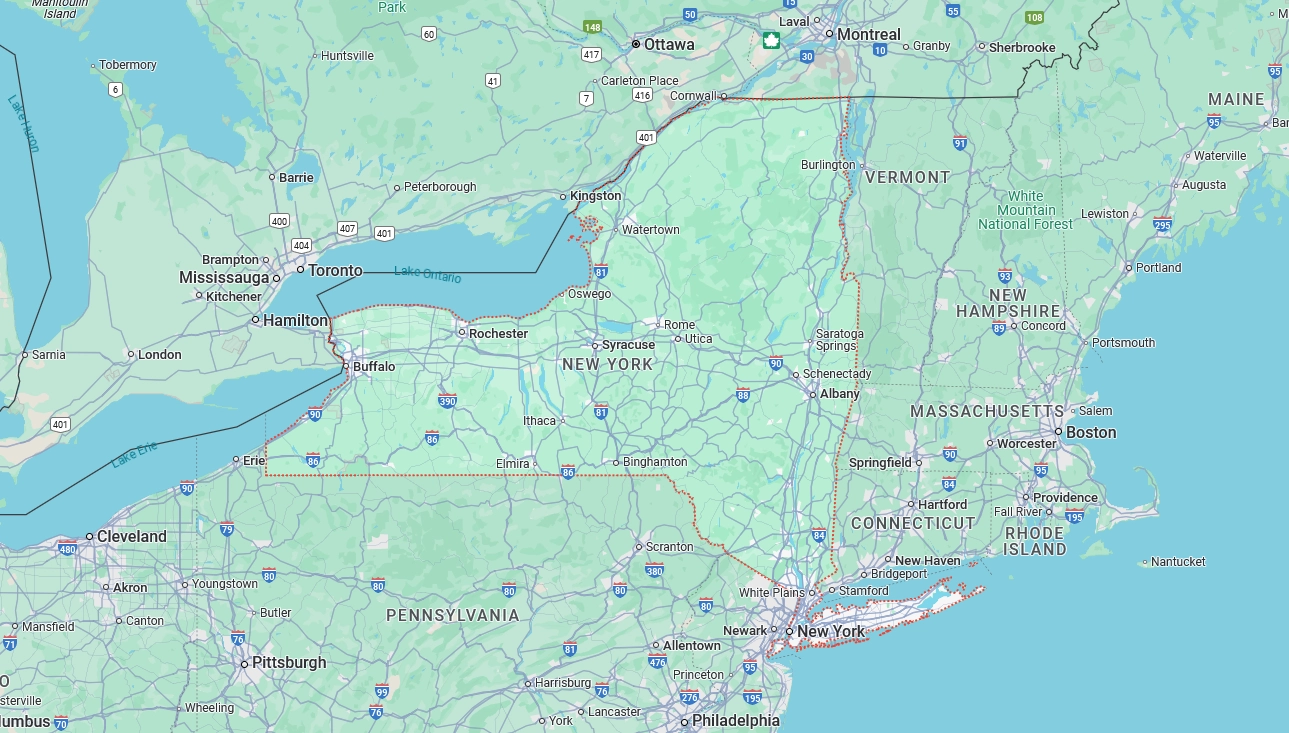

Lawsuit Funding Availability in New York (NY)

Lawsuit Funding Availability in New York (NY)

Lawsuit funding is increasingly popular in New York, with lawsuit loans being available for plaintiffs in financial need.

Tribeca Lawsuit Loans offers flexible legal funding amounts to help cover medical bills, lost wages, and other living expenses while you await settlement.

Our pre-settlement funding options ensure you don’t have to settle for less because of financial pressure. This non-recourse funding is available to plaintiffs in different types of cases, which can include personal injury, medical malpractice, and wrongful death.

Why Should You Trust Tribeca?

We focus on our clients more than anything. That’s how we hit the milestones every year!

Types of Cases that Qualify for Lawsuit Loans in New York

Avoid the economic pressures that could cause you to settle your claim for less money than it is worth. With legal funding, you can continue your case with confidence, knowing you have the financial backing to hold out for a fair settlement. Tribeca provides lawsuit loans for a variety of case types in New York, including:- No Credit Check

- 24hr Funding

Is Lawsuit Lending in New York Legal?

Lawsuit loans are tightly regulated in New York and must comply with state-specific regulations. In New York, lawsuit funding is subject to disclosure requirements and must be offered by licensed funding companies. These loans are reviewed under New York legal standards and are non-recourse by design, which means they are repaid after settlement only.

Lawsuit loans are different from traditional bank loans, as they do not require collateral or credit checks, and they are contingent upon the outcome of your case.

Tribeca Lawsuit Loans ensures compliance with all New York regulations to provide you with secure and transparent pre-settlement funding options.

How To Get a Lawsuit Loan With a Bad Credit in New York?

At Tribeca, we understand that bad credit can be a concern for many plaintiffs. That’s why our lawsuit loans do not involve a credit check. Approval is based entirely on the strength of your case and does not affect your credit rating.

With non-recourse loans, you don’t have to worry about repaying the funding if you lose your case. This means you can access the pre-settlement funding you need, without being penalized for your financial history. Our non-recourse loans ensure that even those with financial challenges can access the funds they need.

Lawsuit Funding Availability in New York (NY)

Tribeca offers legal funding statewide, including the following cities and towns near you:- Long Beach

- Manhattan

- Mount Vernon

- New Rochelle

- New York City

- Niagra Falls

- North Tonawanda

- Queens

- Rochester

- Rome

- Schenectady

- Staten Island

- Syracuse

- Troy

- Utica

- Valley Stream

- Westchester

- White Plains

- Yonkers

Is There a Benefit to Choosing a New York-Based Lawsuit Funding Company?

Partnering with a New York-based lawsuit funding company like Tribeca can offer plaintiffs a sense of reliability and understanding of the local legal context. Our deep knowledge of New York’s legal regulations ensures we meet state-specific requirements, giving you confidence in the process. Being local allows for faster communication with your attorney and the courts, enabling quicker responses to your needs and efficient, tailored support throughout the funding process.

What Happens if I Lose My Case?

One of the biggest concerns potential plaintiffs have is the possibility of losing their case and still owing money. With Tribeca Lawsuit Loans, there’s no risk. Our loans are non-recourse, which means you repay only if you win or settle your case. If you lose, you owe nothing.

This non-recourse structure provides peace of mind, knowing you won’t be financially burdened if the case doesn’t go in your favor.

Get Lawsuit Funding in These States

Why Choose Tribeca in New York (NY)

24-Hour Approval Process

Get 24-hour approval and access to your funds that can help cover immediate living expenses.

Funding up to $2 Million

Get access to pre-settlement funding ranging from $500 to $2 million.

Transparent Terms

Enjoy clear, straightforward terms with no hidden fees or surprises throughout the process.

Flexible Repayment Options

Repay only if you win or settle your case, with flexible options to fit your financial situation.

No Upfront Fees

There are no upfront costs. Funding is provided, and no initial payments are required.Regulation of Lawsuit Loans in New York

In New York, lawsuit loans are governed by strict consumer financial protections. These funds are non-recourse by design and must comply with New York’s usury laws. Lawsuit loans are also subject to disclosure requirements that ensure the borrower understands the terms of the agreement.

What Paperwork is Needed for a Lawsuit Loan In New York?

To apply for a lawsuit loan in New York, you will need to provide some basic legal paperwork. Tribeca works closely with your attorney to review your case and ensure everything is in order before approval. The key documents typically include case details, a signed agreement with your attorney, and proof of any relevant medical records or accident reports.

How Much Funding Can I Qualify For?

The amount of funding you can qualify for depends on the type and strength of your case. Tribeca offers legal funding ranging from as little as $500 to as much as $2 million. The funding amount will vary based on the expected settlement value of your case, and each application is customized to meet your specific needs.

Get Started Today

Fill out the form for a free consultation and quote. Get cash as soon as 24 hours of approval."*" indicates required fields