Boston, MA Lawsuit Loans

Get Cash While Your Case SettlesBoston residents pursuing personal injury cases often face overwhelming financial struggles while waiting for settlements. Massachusetts lawsuit loans provide cash advances to plaintiffs awaiting settlement in Boston, helping cover pressing expenses such as medical bills, rent, and legal costs. These non-recourse funding options allow plaintiffs to pay bills before case resolution and reduce financial stress.

As we offer immediate access to funds without waiting for court decisions, our Boston lawsuit loans are great for maintaining financial stability during litigation.

- Repay $0 If You Lose

- Get Cash In 48 Hours

- Lowest Rate

- Repay $0 If You Lose

- No Credit Check

- 24hr Funding

How to Apply for Lawsuit Funding in Boston, MA

Applying for a lawsuit loan with Tribeca in Boston is a fast and easy process. You can get cash advances to help cover bills, medical expenses, or other costs while your case is pending, with repayment only if your settlement is successful.

-

1

Submit Online Application

Fill out our online application form with your case details or call 866-388-2288 to talk to our team. We are available 24/7.

-

2

Wait for Approval

Our team will review your case, confirm its validity, and ensure it meets our funding criteria. We always evaluate case merit before funding.

-

3

Get Your Funds

Upon approval, receive the funds directly in your bank account in as little as 24 hours. Tribeca disburses funds quickly in Boston.

What Types of Cases Qualify for Lawsuit Loans in Boston?

Tribeca Lawsuit Loans offers short-term pre-settlement funding for a variety of case types in Boston, MA:Boston: Benefits of Choosing Settlement Loans from Tribeca

No-risk, non-recourse funding

You repay only if your case settles successfully. If you lose, you owe nothing.

Fast access to funds

Many Boston plaintiffs receive cash advances within 24 business hours, helping maintain financial stability.

Plaintiff-focused support

We work directly with your attorney to ensure funding meets your case-specific needs. We help attorneys support clients financially during litigation.

Flexible terms

Competitive fees and customized repayment schedules help reduce stress during litigation.What Our Clients Are Saying

Boston: Standards for Lawsuit Loan Approval

Lawsuit loans in Boston provide cash advances to plaintiffs awaiting settlement. This helps cover living and medical expenses during ongoing lawsuits. Relevant advances offer immediate access to funds without waiting for court decisions and are non-recourse, meaning repayment is only required if the plaintiff wins the case. The legal claim is typically approved based on the strength of the case, rather than personal financial history.

To qualify for a lawsuit loan in Boston, applicants typically must meet the following standards:

- Pending Legal Case: An active lawsuit must be underway; funding is an advance against anticipated settlements.

- Legal Representation: Applicants must be represented by a qualified attorney.

- Viable Case: The lawsuit should have a strong likelihood of success, supported by compelling evidence such as medical records, accident reports, and legal filings.

- Transparency: Open communication about case details is critical during the application process.

- Defendant’s Ability to Pay: Demonstrating that the defendant or insurer can cover damages is often required.

These standards ensure that plaintiffs in Boston can access funding to pay bills, medical expenses, and legal fees, thereby reducing financial stress during litigation and maintaining stability while their cases progress.

Apply Today

"*" indicates required fields

Other States That We Serve

Boston: Avoid Settling Prematurely with Our Litigation Funding

Without financial aid, victims may settle for less to make ends meet. Boston pre-settlement funding gives you the confidence to wait for full compensation. Legal funding is also non-recourse under Massachusetts law, so you don’t have to worry if you lose your case. You only need to pay when you win your case.

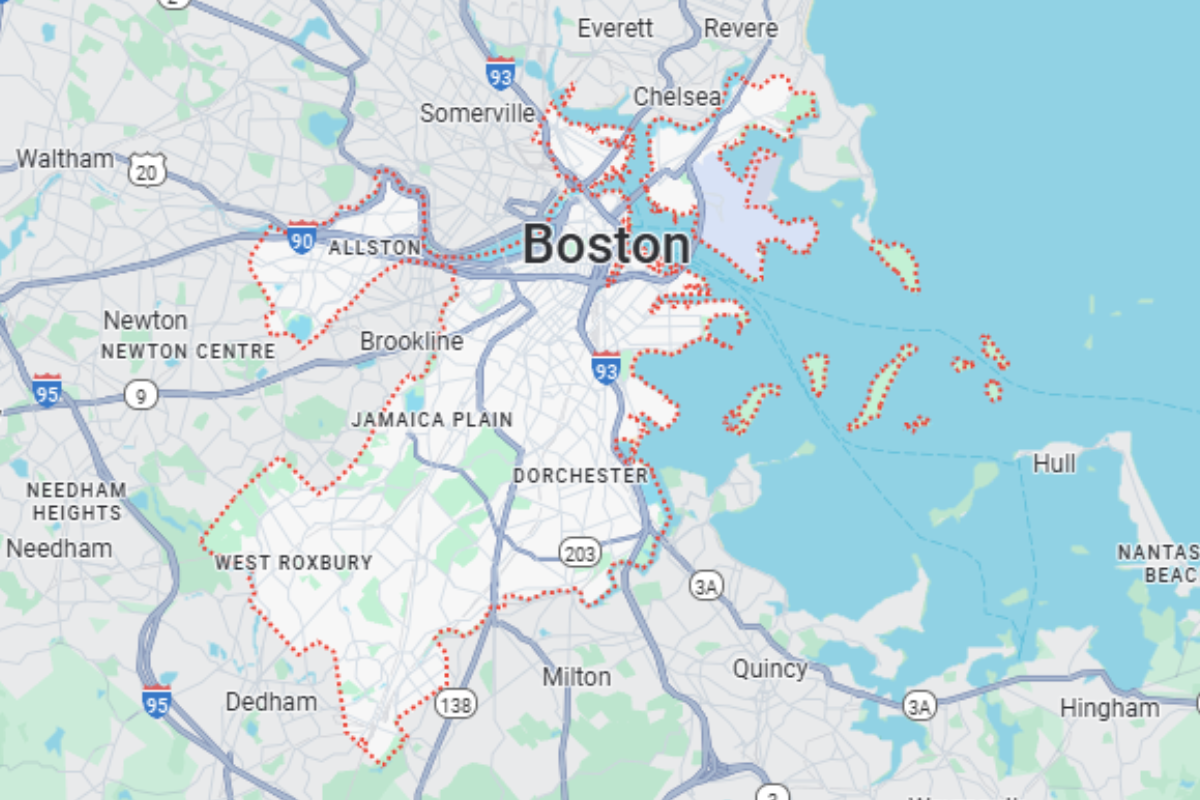

Lawsuit Funding Availability in Massachusetts (MA)

Tribeca offers legal funding statewide, including the following cities and towns near you:Quick Reference Guide to Lawsuit Loans in Boston, MA

Boston plaintiffs awaiting settlement can access lawsuit loans to cover living and medical expenses while their cases progress through the city’s courts, including the Suffolk County Superior Court and the Boston Municipal Court, which handle most personal injury, slip-and-fall, and workplace accident claims.

Typical personal injury cases in Boston may take 12–24 months to resolve, creating a financial gap for plaintiffs. Massachusetts regulates legal funding under strict consumer protection laws, ensuring transparency, capped fees, and non-recourse repayment. Tribeca Lawsuit Loans provide cash advances to plaintiffs in Boston, help pay bills before case resolution, and reduces financial stress while litigation is ongoing.

What Happens if My Lawsuit is Unsuccessful After Receiving Lawsuit Funding?

Most lawsuit loans in Boston are non-recourse, meaning you repay only if your case is won or settled. If your personal injury, workers’ compensation, or accident claim is unsuccessful, you owe nothing, providing financial relief and reducing stress while understanding the legal process under Massachusetts consumer protection laws.

Request a Quote

Getting pre-settlement funding in Boston is fast, simple, and risk-free. Tribeca Lawsuit Loans provides cash advances to plaintiffs awaiting settlement in Boston, helping cover living and medical expenses while your case is ongoing. Our easy application process requires minimal paperwork, a review of your pending legal case, and works directly with your attorney to ensure timely funding. Most approvals are granted quickly, giving you immediate access to funds without waiting for court decisions. Call us toll-free at 866-388-2288 to speak with a funding specialist, or click Apply Now to start your free, no-obligation application. Apply NowGet Started Today

Fill out the form for a free consultation and quote. Get cash as soon as 24 hours of approval."*" indicates required fields