Arlington Lawsuit Loans

Get Cash While Your Case SettlesIf you are going through a personal injury case in Arlington, the financial pressure can be difficult to handle. Lawsuit loans can help ease some of that burden. Legal funding offers financial support before your settlement is reached. These funds help cover legal expenses, like medical bills or legal costs.

Arlington lawsuit loans are tailored to meet the needs of plaintiffs during litigation and are processed quickly with the help of your attorney. Best of all, these loans do not require good credit, do not affect your credit score, and are typically non-recourse, meaning you only repay if you win your case.

- Repay $0 If You Lose

- Get Cash In 48 Hours

- Lowest Rate

- Repay $0 If You Lose

- No Credit Check

- 24hr Funding

What Our Clients Say

Applying for a Lawsuit Loan in Arlington, VA

With Tribeca Lawsuit Loans, applying for a lawsuit loan in Arlington is a simple process. We do not do credit checks or employment verifications.

-

1

Apply Online

Start by submitting an application online. You can also call our toll-free number. The process is quick. We ask for basic details about your case.

-

2

Case Review

Our specialists will review your case with your attorney to ensure it meets the necessary criteria. No credit check is required, just the strength of your case.

-

3

Receive Your Funds

Once approved, your funds are quickly processed and sent to you. You can receive your lawsuit loan in as little as 24 hours to cover living costs, medical bills, or legal expenses.

Tribeca Lawsuit Loans ensures that the process is simple, fast, and compliant with Virginia laws, giving Arlington residents the financial support they need during litigation.

5 Star Reviews

Types of Cases We Fund in Arlington

Tribeca Lawsuit Loans provides comprehensive pre-settlement funding for a variety of case types in Arlington:Arlington: Benefits of Choosing Lawsuit Loans from Tribeca

Fast processing and quick access to funds

Fast processing and quick access to funds  No credit check or upfront fees

No credit check or upfront fees  Non-recourse loans: pay only if you win

Non-recourse loans: pay only if you win

Attorney involvement to ensure compliance with Virginia laws

Attorney involvement to ensure compliance with Virginia laws  Tailored for personal injury and other civil cases

Tailored for personal injury and other civil cases Arlington: Qualifying for Lawsuit Funding

To qualify for pre-settlement funding in Arlington, VA, you must:

- Have a pending personal injury claim or other civil lawsuit.

- Be represented by a licensed attorney who is actively involved in your case.

- Have a strong, viable case with evidence of liability, damages, and the potential for compensation.

At Tribeca Lawsuit Loans, we offer fast funding based on your anticipated settlement, so credit checks and income verification are not required. Approval is determined solely by the strength of your case, not your financial ability to pay. This means that Arlington plaintiffs can access the funds they need without worrying about their credit score or employment history.

Apply Today

"*" indicates required fields

Get Lawsuit Funding in These States

Arlington: Avoid Settling Prematurely with Our Lawsuit Funding

Financial stress can pressure plaintiffs in Arlington, Virginia, to settle their lawsuits prematurely, often for less than they deserve. Lawsuit loans are available to Arlington residents as a financial solution during litigation. These funds offer immediate support before settlement, helping cover legal expenses and living costs without the need for good credit.

The non-recourse nature of these advances means plaintiffs are not burdened with repayment if they lose their case. By supporting plaintiffs during civil proceedings, lawsuit loans empower clients to resist settling too quickly, improving their ability to secure a fair settlement by giving them the financial freedom to wait for a favorable resolution.

Lawsuit Funding Availability in Virginia (VA)

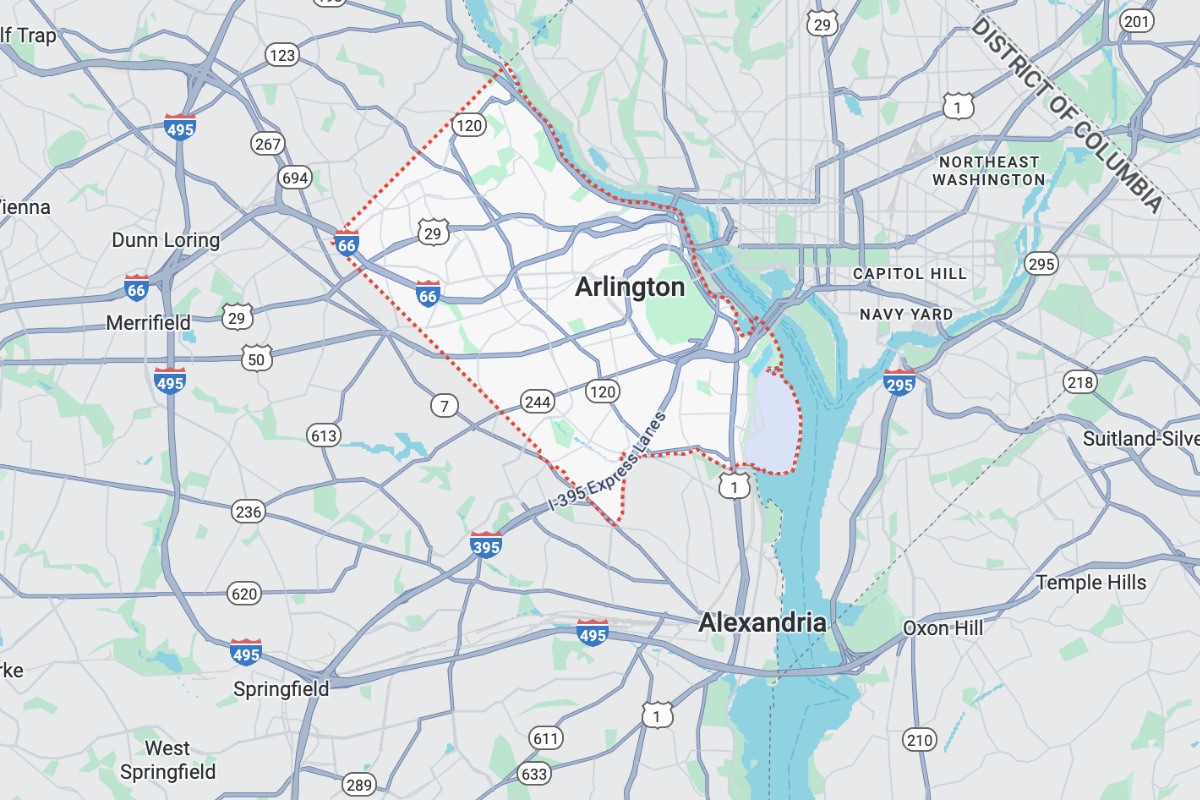

Tribeca offers legal funding statewide, including the following cities and towns near you:- Alexandria

- Arlington

- Charlottesville

- Chesapeake

- Danville

- Fredericksburg

- Hampton

- Harrisonburg

- Leesburg

- Lynchburg

- Manassas

- Newport News

- Norfolk

- Petersburg

- Portsmouth

- Richmond

- Roanoke

- Suffolk

- Virginia Beach

- Winchester

Overview of Lawsuit Loans in Arlington

Lawsuit loans are available to Arlington residents involved in personal injury cases. These financial tools help cover legal expenses and living costs before settlement. Therefore, they offer crucial support during litigation. In Virginia, lawsuit loans are typically non-recourse, meaning repayment is required only if the plaintiff wins the case. They do not require good credit and do not affect credit scores, making them accessible to plaintiffs regardless of their financial history.

Arlington’s General District Court handles civil cases with a simple process that allows for quicker resolutions compared to higher courts. This efficiency can be beneficial for plaintiffs looking for fast financial relief. Lawsuit loans are typically processed within 24 hours. They also require attorney involvement to ensure proper legal procedures are followed. Legal funding companies offering these loans review cases to understand their strength and determine eligibility.

VA Laws That Affect Pre-Settlement Loans in Arlington

Virginia does not have specific state laws directly regulating lawsuit funding, which means the practice operates largely without direct oversight at the state level. However, legal funding companies offering pre-settlement loans in Arlington must still comply with general consumer protection laws under the Virginia Consumer Protection Act (VCPA). These laws ensure transparency in terms and prevent unfair practices.

While lawsuit loans in Virginia are typically non-recourse and based on the strength of your case, funding companies must adhere to ethical standards. This makes sure that fees are clear and upfront, with no hidden costs.

Request a Quote

Tribeca Lawsuit Loans offers a quick application process with minimal paperwork. You may need financial support to cover living expenses or legal costs during your pending lawsuit. We are here to help. Our team reviews your case promptly. We work directly with your attorney to expedite the process. You can apply online or by calling us at 866-388-2288 to speak with one of our friendly case specialists. Get the support you need today. Our pre-settlement funding is available to Arlington residents with no impact on your credit score. Apply NowGet Started Today

Fill out the form for a free consultation and quote. Get cash as soon as 24 hours of approval."*" indicates required fields