Finding the right lawsuit loan company can be challenging. On the surface, they may look the same, but the wrong choice can cost you time, money, and peace of mind. Reading client lawsuit funding reviews can provide valuable insight into service quality, funding speeds, and transparency that goes beyond what marketing materials reveal.

To simplify the process, we’ve reviewed the top pre-settlement funding companies in 2026 and gathered practical advice to help you make the best choice.

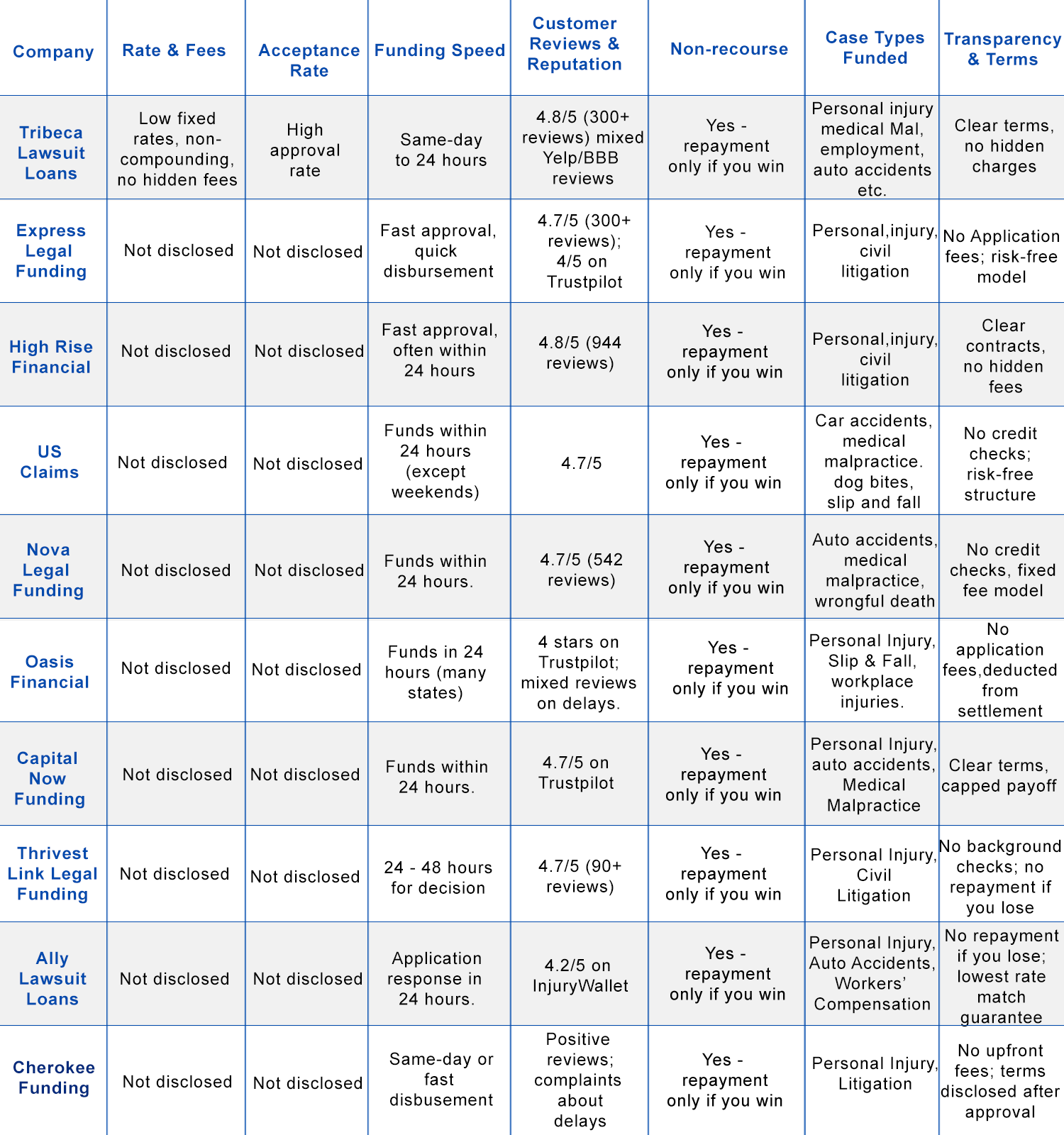

Here’s our breakdown of the Top 10 Lawsuit Loan Companies in the U.S., so you can see which lender may be the best fit for your case.

Overview of the Top 10 Lawsuit Loan Companies

Top 10 Pre-settlement Funding and Lawsuit Loan Companies

Here are ten of the most reputable lawsuit loan companies in the U.S. for 2026. Each offers different benefits, from fast approvals to flexible terms, and all operate on a non-recourse basis, so you only repay if you win your case.

1. Tribeca Lawsuit Loans– (866) 388-2288

- Rates & Fees: Low fixed rates, non-compounding, no hidden fees reported.

- Acceptance Rate: High approval rate; most qualified applicants accepted.

- Funding Speed: Same-day to 24 hours once documents are complete.

- Customer Reviews & Reputation: 4.8/5 average rating; strong reputation in industry.

- Non-Recourse Structure: Yes — repayment only if you win.

- Case Types Funded: Personal injury, medical malpractice, employment, auto accidents, and more.

- Transparency & Terms: Clear terms, upfront costs disclosed, no hidden charges.

- Application Process: Simple online or phone application; attorney cooperation required.

- Customer Service & Communication: Highly rated for support and responsiveness.

- Regulatory Compliance & Trust Symbols: Verified company with 20+ years of experience.

| Pros | Cons |

| Fast funding, often within 24 hours | Rates not publicly listed on website |

| Non-recourse, risk-free if you lose | Attorney cooperation required for approval |

| Broad range of case types funded | Funding limits vary by case strength |

| Strong customer reviews and reputation | Some negative reviews mention delays |

2. Express Legal Funding

- Rates & Fees: Not disclosed publicly.

- Acceptance Rate: Not disclosed

- Funding Speed: Promotes fast approvals and quick disbursement of funds.

- Customer Reviews & Reputation: 4.7/5 rating on Birdeye from 300+ reviews; Trustpilot averages around 4/5 from fewer reviews.

- Non-Recourse Structure: Yes — repayment only if you win.

- Case Types Funded: Personal injury and other civil litigation cases.

- Transparency & Terms: No application fees; promotes a risk-free funding model

- Application Process: Free online or phone application with attorney participation required

- Customer Service & Communication: Reviews note responsiveness and helpful client support.

- Regulatory Compliance & Trust Symbols: BB-accredited with an A+ rating; in business since 2015.

| Pros | Cons |

| Non-recourse structure; repayment only if you win | Rates and fees not publicly disclosed |

| Free application with no upfront costs | Acceptance rate not published |

| BBB-accredited with A+ rating | Limited number of independent reviews compared to larger competitors |

| Positive client feedback on responsiveness | Funding speed not clearly guaranteed |

3. High Rise Financial

- Rates & Fees: Not disclosed publicly.

- Acceptance Rate: Not disclosed.

- Funding Speed: Approvals and funding are marketed as fast, often within 24 hours.

- Customer Reviews & Reputation: Rated 4.8/5 on Google (944 reviews); testimonials report fast funding and positive experiences.

- Non-Recourse Structure: Yes — repayment only if you win.

- Case Types Funded: Personal injury and civil litigation claims.

- Transparency & Terms: Promotes clear contracts and no hidden fees.

- Application Process: Simple online application process; attorney involvement is required

- Customer Service & Communication: Clients describe the team as responsive, caring, and helpful.

- Regulatory Compliance & Trust Symbols: BBB-accredited since October 2020

| Pros | Cons |

| Fast approval and funding process | Rates and fees are not publicly disclosed |

| Non-recourse structure (you only repay if you win) | No published acceptance rate |

| BBB accreditation adds some external credibility | Case types are limited to injury/litigation (less diversity) |

| Strong customer testimonials highlighting care and responsiveness | Because the company is newer (BBB accreditation since 2020), it has less long-term track record |

4. US Claims

- Rates & Fees: Not disclosed.

- Acceptance Rate: Not disclosed.

- Funding Speed: Funds typically available within 24 hours (except weekends).

- Customer Reviews & Reputation: 4.7/5 rating; long-standing, trusted company.

- Non-Recourse Structure: Yes — repayment only if you win.

- Case Types Funded: Car accidents, medical malpractice, surgery funding, dog bites, premises liability, slip and fall.

- Transparency & Terms: Emphasizes no credit checks and risk-free structure; detailed rates not public.

- Application Process: Simple process with attorney involvement.

- Customer Service & Communication: Praised for excellent client service.

- Regulatory Compliance & Trust Symbols: Verified company; 25 years in business.

| Pros | Cons |

| Funds often within 24 hours | Rates not publicly disclosed |

| Covers a broad range of cases | Weekend funding not available |

| Strong reputation and reviews | Limited transparency on fees |

| 25 years of industry experience | Dependent on attorney cooperation |

5. Nova Legal Funding

- Rates & Fees: Not disclosed publicly; they claim to charge a fixed fee (non-compounded) tied to case strength.

- Acceptance Rate: Not disclosed.

- Funding Speed: Funds usually delivered within 24 hours of approval.

- Customer Reviews & Reputation: 4.7/5 from 542 reviews on their site; many client testimonials.

- Non-Recourse Structure: Yes — repayment only if you win.

- Case Types Funded: Auto accidents, defective medical devices, employment law claims, medical malpractice, slip & fall, wrongful death, premises liability.

- Transparency & Terms: Promotes no credit checks, no application fees, fixed fee model; limited public detail.

- Application Process: Online or phone application, attorney review required.

- Customer Service & Communication: Testimonials praise speed, professionalism, and helpful guidance.

- Regulatory Compliance & Trust Symbols: Operating since ~2015; covers most U.S. states (with exceptions).

| Pros | Cons |

| Rapid funding, often within 24 hours | Rates and fees are not publicly disclosed in detail |

| Non-recourse (you don’t repay if you lose) | Acceptance rate unknown |

| Broad slate of case types financed | Some terms only described generally |

| Transparent policy (no credit check, no hidden fees) | Does not operate in certain states due to legal restrictions |

6. Oasis Financial

- Rates & Fees: Not disclosed publicly.

- Acceptance Rate: Not disclosed.

- Funding Speed: Funds available within 24 hours of approval in many states.

- Customer Reviews & Reputation: Rated 4 stars on Trustpilot; ConsumerAffairs reviews cite strong support but also complaints about delays and fees.

- Non-Recourse Structure: Yes — you repay only if your case succeeds; if you lose, you owe nothing.

- Case Types Funded: Primarily personal injury and civil litigation claims (auto accidents, slip & fall, workplace injuries).

- Transparency & Terms: No application fees; fees and charges are deducted from settlement proceeds.

- Application Process: Free, no-obligation application with attorney review required

- Customer Service & Communication: Many testimonials highlight helpful, responsive staff though some complaints note delays and transparency issues.

- Regulatory Compliance & Trust Symbols: BBB-accredited with A+ rating; founding partner of responsible lending associations (ARC, APA).

| Pros | Cons |

| Non-recourse funding (no payment obligation if you lose) | Rates and fees not publicly detailed |

| Funds often available within 24 hours | Acceptance rate unknown |

| No application fees | Some complaints about transparency and process delays |

| BBB A+ rating and industry association memberships | Regulatory history in some states |

7. Capital Now Funding

- Rates & Fees: Uses a fixed-fee model with zero recurring interest (you owe the same amount regardless of how long your case lasts).

- Acceptance Rate: Not disclosed.

- Funding Speed: Funds typically delivered within 24 hours after approval.

- Customer Reviews & Reputation: Trustpilot reviews state the application is free, fast, and non-recourse, with a fixed fee structure.

- Non-Recourse Structure: Yes — repayment only if you win.

- Case Types Funded: Personal injury and related civil cases (auto accidents, slip & fall, medical malpractice, wrongful death, product liability).

- Transparency & Terms: Fixed fee structure, no recurring interest, and a capped payoff are all clearly presented.

- Application Process: Simple, free application; after approval, they contact your attorney and send you a contract; once signed, funds are disbursed.

- Customer Service & Communication: Clients mention the process is smooth andthe staff is professional.

- Regulatory Compliance & Trust Symbols: Operating since 2015; headquartered in Louisville, KY.

| Pros | Cons |

| Fixed fee with no recurring interest | Actual rates not publicly disclosed |

| Fast funding after approval | Acceptance rate not disclosed |

| Non-recourse structure | Shorter track record than larger competitors |

| Clear, capped payoff model | Limited independent reviews compared to some larger firms |

8. Thrivest Link Legal Funding

- Rates & Fees: Not disclosed publicly.

- Acceptance Rate: Not disclosed.

- Funding Speed: Funding decisions are generally made in 24–48 hours; payouts shortly thereafter.

- Customer Reviews & Reputation: 4.7/5 Trustpilot average from ~90+ reviews.

- Non-Recourse Structure: Yes — repayment only if the case settles in your favor.

- Case Types Funded: Various personal injury and civil litigation cases (auto accidents, slip & fall, medical/surgical, etc.).

- Transparency & Terms: Promotes no-background-check applications and “no repayment unless your case settles.”.

- Application Process: Online application, underwriter review, contract signing, then funding.

- Customer Service & Communication: Clients frequently praise speed, clarity, and responsive staff.

- Regulatory Compliance & Trust Symbols: BBB-accredited since 2016 with A+ rating; business started in 2009.

| Pros | Cons |

| Quick funding in 24–48 hours | Rates and fees are not publicly disclosed |

| Non-recourse structure | Acceptance rate unknown |

| BBB accreditation with a strong rating | Limited underwriting transparency |

| Positive client feedback on responsiveness | Competition is intense; newer in the legal funding space |

9. Ally Lawsuit Loans

- Rates & Fees: Not disclosed publicly; they claim to offer a “lowest interest rate guarantee.”

- Acceptance Rate: Not disclosed.

- Funding Speed: Application response within 24 hours; funding sometimes available soon after acceptance.

- Customer Reviews & Reputation: InjuryWallet notes a 4.2/5 average based on 31 online reviews. Trustpilot and other review sites show mixed feedback.

- Non-Recourse Structure: Yes — repayment only if the case is won (you owe nothing if case is lost).

- Case Types Funded: Personal injury, auto accidents, workers’ compensation, wrongful termination, defective medical devices, etc.

- Transparency & Terms: They promise no repayment if you lose, and a lowest-rate match guarantee; but they do not publish full rate schedules.

- Application Process: Submit application online; they coordinate with your attorney.

- Customer Service & Communication: Some reviews praise fast responses; others raise concerns about communication delays.

- Regulatory Compliance & Trust Symbols: Not enough evidence to confirm key accreditations; presence in review directories and public listings.

| Pros | Cons |

| Non-recourse structure (you don’t pay if you lose) | Rates & detailed fees are not publicly disclosed |

| Fast response to applications (24h) | Acceptance rate unknown |

| Broad range of case types funded | Mixed reviews on communication and transparency |

| Lowest rate guarantee promise | Limited independent verification and fewer documented metrics |

10. Cherokee Funding

- Rates & Fees: Not publicly disclosed; fees and interest vary based on case risk.

- Acceptance Rate: Not disclosed.

- Funding Speed: Typically same-day or very fast disbursement once approved.

- Customer Reviews & Reputation: Rated positively by some review platforms; clients cite no upfront fees and fair structuring.

- Non-Recourse Structure: Yes — repayment only if the case succeeds.

- Case Types Funded: Primarily personal injury and litigation claims.

- Transparency & Terms: Doesn’t charge up-front fees; interest and repayment terms are disclosed only post-approval.

- Application Process: Application begins online; terms finalized upon contract negotiation.

- Customer Service & Communication: Some complaints regarding promise of “single-day turnaround” not always met.

- Regulatory Compliance & Trust Symbols: Underwent litigation (Ruth v. Cherokee Funding) over contract terms and interest structure.

| Pros | Cons |

| Non-recourse agreement means no payment if case fails | Rates and fees not fully transparent before approval |

| No upfront application fees charged | Acceptance/approval rates not published |

| Fast funding when approved | Some promises (e.g. same-day approval) don’t always hold |

| Broad industry presence | Past legal challenges over contract terms and fee structures |

How to Choose the Right Lawsuit Loan Company For You

Not all lawsuit loan companies are the same. Choosing the wrong one can cost you more than you expect. Plaintiffs should evaluate each company’s terms, structure, and reputation before committing. Here are the key factors to consider when selecting the right provider:

- Broker vs. Direct Funder – Some companies operate as brokers and charge additional fees to connect you with third-party lenders. Direct funders provide the money themselves, which eliminates extra broker costs, but it also means you need to compare multiple direct funders to ensure you’re getting the best rate.

- Non-Recourse Funding – Always confirm that the funding is non-recourse. This means you only repay the advance if you win your case, protecting you from the risk of going into debt if your lawsuit is unsuccessful.

- Transparent & Simple Interest Rates – Look for companies that clearly state their interest rates and avoid compounding interest. Simple, fixed rates give you predictable repayment terms and help you keep more of your settlement.

- No Upfront Charges – Reputable lawsuit loan companies will not ask for application fees, processing fees, or out-of-pocket costs. All charges should come out of your settlement only after you win.

- Speed of Approval & Funding – The best companies can approve your application quickly and provide funds within 24–48 hours. Fast access to money can make the difference when you’re under financial pressure.

- Reputation & Customer Reviews – Check authentic reviews on Google, Trustpilot, BBB, and social media. Positive feedback from past clients is a strong indicator of reliable service, while consistent complaints are a red flag.

- No Credit Check or Employment Verification – Legal funding is based on the strength of your case, not your credit score or job history. Companies that advertise no credit check and no employment verification make the process faster and less stressful for plaintiffs.

- Strong Attorney Communication & Due Diligence – A good funding company will work closely with your lawyer to gather accurate details about your case. This prevents false assumptions, ensures your case is evaluated fairly, and speeds up the funding process.

How Does Lawsuit Loan Work?

A lawsuit loan provides a cash advance based on the expected settlement of your case. The loan is repaid only if you win your case or reach a settlement, meaning there’s no financial obligation if your case is unsuccessful. These funds can be used to cover living expenses, medical bills, or legal fees while waiting for the lawsuit to conclude.

The amount you can borrow depends on the strength of your case and its potential settlement value. If you’re interested in learning more about how lawsuit loans work, you can check out Tribeca’s lawsuit loans page.

Pros and Cons of Pre-settlement Funding

Pre-settlement funding can provide essential financial relief when you’re facing mounting expenses during a lawsuit. It offers the ability to cover living costs, medical bills, and legal fees while you wait for your case to resolve. Additionally, it can give you more negotiation power, allowing you to reject lowball settlement offers from the opposing party.

However, pre-settlement funding also comes with its downsides. The most significant factor to consider is the cost. The fees and interest rates can be high, especially if your case takes longer to settle. Furthermore, the amount you can borrow is based on the strength of your case, so not all plaintiffs will qualify for the funding they need. It’s crucial to weigh the benefits of immediate relief against the long-term financial impact of the funding.

When considering pre-settlement funding, Tribeca Lawsuit Loans provides competitive options with low rates and no hidden charges. You can find out more about pre-settlement funding here.

Why Choose Tribeca For Lawsuit Loans?

At Tribeca Lawsuit Loans, we help plaintiffs like you resist the delays and lowball offers from defense attorneys so they can win the compensation they deserve. We welcome your legal lending questions before, during, and after the loan application process. You can contact us online or give us a call at (866) 388-2288. A friendly team member will be happy to assist you!

You can apply for legal funding by phone or visit our Apply Now page to get started! Soon, the financial pressure will ease so you can get the compensation your case deserves.

For those interested in structured settlement loans, visit our Best Structured Settlement Loan Company page for further information.

Frequently Asked Questions about Legal Funding Companies

Which is the Best Lawsuit Loan Company?

Tribeca Lawsuit Loans is a top provider of pre-settlement funding, offering non-recourse loans where repayment is only required if you win or settle your case. The process is quick, with approvals and funding completed in 24-48 hours. Tribeca offers clear terms, with no hidden fees, and provides funding for various cases, including personal injury, medical malpractice, and wrongful death. With over 30 years of experience and an A+ BBB rating, Tribeca has helped over 150,000 clients, making it a trusted choice for plaintiffs.

Do I Need an Attorney to Get Lawsuit Funding?

Yes, an attorney is typically required. The funding company works with your lawyer to assess the case and determine its value. The loan is repaid from the settlement, so your attorney facilitates the process.

What Types of Cases Can You Get a Lawsuit Loan For?

You can get a lawsuit loan for many different types of cases, depending on the company you choose and what they offer.

As an individual plaintiff, some common cases that you can get a personal legal funding for are personal injury, premises liability, police brutality, wrongful death and more. assault & battery, medical malpractice, dog bites, auto accidents, workplace discrimination, workplace harassment, wrongful termination, unpaid wages, Qui Tam / whistleblower, FELA claims, Jones Act claims, construction accidents, non-medical product liability, defective medical devices, dangerous pharmaceutical drugs, settled claims, dram shop claims, and workers’ compensation.

How much interest do legal funding companies charge?

The top legal funding companies will typically charge a low interest rate between 1-6% per month, non-compounding. Some companies advertise their rates, others don’t.

How Long Does It Take to Get a Settlement Loan?

Most companies approve and fund within 24–48 hours once all documents are submitted. Some offer same-day funding for straightforward cases.

Can I Borrow Money From My Lawsuit?

Yes, you can borrow against the expected settlement of your lawsuit. The loan is repaid only if you win or settle your case.

Are Lawsuit Loans Worth It?

Lawsuit loans offer fast relief but come with high interest rates and fees. Consider the costs versus the need for immediate funds before applying.

What if I Lose My Case?

You don’t have to repay the loan if you lose. Lawsuit loans are non-recourse, meaning you only repay if you win or settle.

Need a Lawsuit Loan? Next Step: Apply Today with Tribeca

At Tribeca Lawsuit Loans, we strive to provide you with the best legal funding options in the country. We are a legal finance company that offers lawsuit loans for a broad array of cases.

We are deeply invested in making democracy and justice more accessible to all. Your finances should not be a barrier to getting the fair hearing and compensation your case deserves. Just provide some information on our Apply Now page 24/7 or call us at 866-388-2288.