Inland Empire Lawsuit Loans

Get Cash While Your Case SettlesIn the Inland Empire, many plaintiffs turn to legal funding solutions to manage medical bills, legal costs, and other urgent fees while pursuing compensation. California lawsuit loans help plaintiffs secure funding during the demanding times of a personal injury case.

At Tribeca Lawsuit Loans, our financial products help you hold out for the settlement amount you deserve.

- Repay $0 If You Lose

- Get Cash In 48 Hours

- Lowest Rate

- Repay $0 If You Lose

- No Credit Check

- 24hr Funding

How to Apply for Legal Funding in the Inland Empire

Tribeca Lawsuit Loans offers risk-free loans for plaintiffs in the Inland Empire. Our application process is simple to provide the financial support you need during litigation as quickly as possible. No credit checks needed.

-

1

Submit the Application Form

Fill out our online application form or call us at 866-388-2288. Include basic details about your personal injury case.

-

2

Get a Case Evaluation

We’ll assess your case, with the assistance of your attorney or legal counsel, to ensure it meets our approval criteria.

-

3

Receive Your Pre-Settlement Funding

Get approval in as little as 24 hours. Receive anywhere from $500 to $2 million directly into your bank account.

Benefits of Choosing Lawsuit Loans from Tribeca

Tribeca stands out among legal funding companies in the Inland Empire. Here’s why clients choose us:- No credit checks, no upfront payment, and transparent interest rates

- Risk-free, flexible approval in as little as 24 hours

- Non-recourse funding, which means you only repay the loan if you win your case

What Our Customers Are Saying

Eligibility and Qualifications for Lawsuit Funding

To qualify for an Inland Empire lawsuit cash advance, you must:

- Be at least 18 years old and have an active legal case underway

- Be represented by a licensed attorney or legal counsel

- Present strong evidence, such as medical documentation and witness statements

- Demonstrate that the opposing party has the financial ability to pay the settlement amount

Note: Your approval is based on the strength of your case, not your credit score. Our lawsuit funding supports plaintiffs in need of urgent cash with a high chance of winning, no matter the financial situation.

Apply Today

"*" indicates required fields

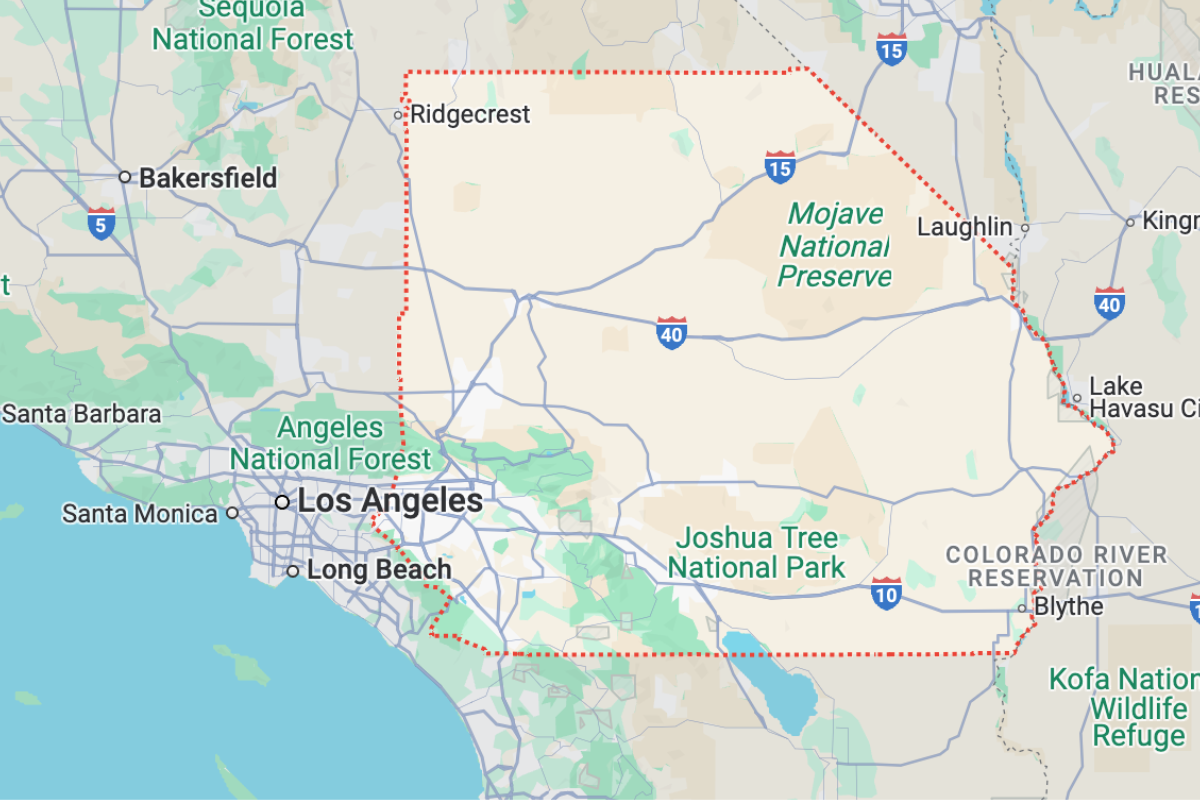

Lawsuit Funding Availability in California (CA)

Tribeca offers legal funding statewide, including the following cities and towns near you:How Lawsuit Loans Help Prevent Premature or Undervalued Settlements

Many plaintiffs are forced to accept unfair settlement loans due to mounting costs. But with Tribeca Lawsuit Loans, you don’t need to compromise your claim just to survive financially. Our pre-settlement funding offers fast approval to help cover court costs, attorney fees, living expenses, and other urgent costs, providing you enough financial breathing room while awaiting settlement.

The non-recourse nature of the settlement loans also reassures plaintiffs that they are not burdened with debt if they lose the case. This financial empowerment helps you prospect for fair compensation.

Other States That We Serve

Lawsuit Funding Loans in the Inland Empire

The Inland Empire, comprising Riverside and San Bernardino counties, is one of the fastest-growing regions in California and a significant hub for civil litigation.

- Primary Venue for Personal Injury Cases: Riverside Historic Courthouse and the San Bernardino Justice Center

- Most Common Types of Personal Injury Cases: Car accidents, slip and fall accidents, and workplace injuries

- Legal Regulations and Procedural Differences: Legal, not barred by champerty or maintenance laws in CA, and is subject to follow general consumer protection laws by the California Department of Financial Protection and Innovation (DFPI), but not regulated by the California Financing Law (Cal. Fin. Code § 22000 et seq.)

At Tribeca Lawsuit Loans, our team stays updated on all California regulations and local court processes to ensure your application aligns with court timelines and litigation procedures, so you can secure lawsuit funding with confidence.

The Legal Process and How Lawsuit Loans Work in Inland Empire, CA

Personal injury cases in the Inland Empire can take several months to resolve. Between retaining a qualified attorney, gathering evidence, filing legal documents, and attending hearings, plaintiffs often face mounting expenses long before they see any compensation.

In the Inland Empire, you can apply for a settlement loan online with Tribeca Lawsuit Loans. Once you’ve submitted your application, we will coordinate with your attorney to check if you have a high chance of winning the case. The amount you get is based on the estimated value of your future settlement, and you’ll only repay the loan if you win your case.

California follows a pure comparative fault rule (Cal. Civ. Code § 1431.2), wherein an injured party can recover damages even if they are 99% at fault for the accident. However, their compensation is reduced by the percentage of fault attributed to them.

Once approved, the estimated value of your case will be deposited into your bank account within 24 hours. We offer non-recourse funding, which means that you only repay if you win the case.

Claim Your Cash Advance from Tribeca Lawsuit Loans

Settlement loans enable plaintiffs to avoid financial hardship during litigation. If you’re struggling with medical bills, lost wages, or emergency expenses, Tribeca is here to help. Begin your Inland Empire lawsuit loan application by completing our online form or calling us at 866-388-2288 to secure the financial support you need. Our services are quick, affordable, and tailored to your needs. No credit checks needed. Get StartedGet Started Today

Fill out the form for a free consultation and quote. Get cash as soon as 24 hours of approval."*" indicates required fields