Lawsuit Loans in Riverside, California

Get Cash While Your Case SettlesLawsuit loans in Riverside offer immediate financial relief when you're facing mounting bills during a personal injury case. Pre-settlement funding helps Riverside residents cover essential expenses such as medical bills, rent, and daily costs while their case settles.

With California lawsuit loans providing same-day access to funds, you can focus on your recovery and legal battle instead of financial stress.

- Repay $0 If You Lose

- Get Cash In 48 Hours

- Lowest Rate

- Repay $0 If You Lose

- No Credit Check

- 24hr Funding

What a Tribeca Lawsuit Loan in Riverside Can Help You With

Managing Daily Living Expenses

When you’re injured and unable to work, basic costs don’t stop. Mortgage payments, groceries, utilities, and car payments continue piling up while your case moves through California’s legal system.

A Riverside lawsuit loan gives you breathing room to maintain your household without depleting savings or falling behind on bills that could damage your credit.

Covering Medical Costs and Ongoing Treatment

Personal injury cases often involve extensive medical treatment that stretches months or years. Your settlement loan can help pay for physical therapy, follow-up surgeries, prescription medications, and specialist visits that insurance doesn’t fully cover.

According to research published in JAMA Network Open (2024), medical debt affects millions of Americans and is associated with worse health outcomes, making lawsuit funding a critical resource for injury victims in Riverside.

Reducing Existing Debt Pressure

Many plaintiffs carry credit card debt, personal loans, or other financial obligations that become unmanageable after an accident.

Legal funding allows you to address these debts and avoid collection actions, repossession, or foreclosure while your attorney works toward fair compensation. You can use Riverside pre-settlement funding to prevent financial emergencies from spiraling into long-term credit damage.

Gaining Strategic Legal Advantage

Access to lawsuit funding fundamentally changes your negotiating position. When you’re not desperate for money, your attorney can reject lowball settlement offers and hold out for maximum compensation.

Insurance companies often pressure injured plaintiffs to accept inadequate settlements by exploiting their financial vulnerability. Funding eliminates that pressure point entirely.

How to Apply for a Lawsuit Loan in Riverside

Applying for legal funding through Tribeca is simple and fast. Our process is designed to help you get the support you need quickly while ensuring compliance with Riverside’s specific regulations.

-

1

Fill Out an Application

Just fill out the form and provide your case details. No credit check is required, which means you can apply without worrying about your credit history.

-

2

Review Your Case

Tribeca will evaluate your case to ensure compliance with California regulations. Our team coordinates directly with your legal counsel to verify case details and ensure all requirements are met for Riverside lawsuit loans.

*Under California Business and Professions Code Section 6154.5, legal funding companies in California must provide certain disclosures and obtain attorney notification before finalizing funding agreements.

-

3

Get Approved & Funded

Once approved, we’ll send over your pre-settlement funding within 24 hours to cover medical bills, legal fees, or other essential costs without delay.

Do You Qualify for a Lawsuit Loan in Riverside?

Active Personal Injury Lawsuit

You need a pending lawsuit filed in California courts to qualify for litigation funding. These advances work against your anticipated settlement or jury award, so your case must be actively moving through the legal process.

If you’ve only consulted an attorney but haven’t filed yet, you’ll need to initiate your lawsuit before applying for a personal injury loan in Riverside.

Legal Representation by a Qualified Attorney

All applicants must work with a licensed California attorney who’s handling their case. Your legal counsel acts as a critical checkpoint in the funding process. They verify case details, assess settlement value, and coordinate repayment when your case resolves.

Without attorney representation, funding companies cannot properly evaluate your claim’s merit or potential compensation amount.

Strong Case with Viable Evidence

Your lawsuit must demonstrate clear liability and damages supported by medical records, accident reports, witness statements, or other documentation.

Cases with compelling evidence of another party’s fault receive faster approval because they present a lower risk to the funder. Weak or disputed claims may not qualify, regardless of your financial need.

No Requirements for Credit Score or Employment

Unlike traditional loans, legal funding focuses entirely on your case strength rather than your financial status.

You won’t face credit checks, income verification, or proof of employment requirements. Your credit history and current job situation are irrelevant to the approval process for Riverside lawsuit funding.

Apply Today

"*" indicates required fields

Avoid Accepting Undervalued Settlement Offers in Riverside

How Financial Desperation Leads to Low Settlements

Insurance companies understand that injured plaintiffs face mounting bills and financial pressure.

Adjusters deliberately delay negotiations and make minimal offers, betting that financially stressed claimants will accept less just to pay urgent expenses.

Financial Breathing Room Changes Everything

Settlement loans provide the financial cushion you need to reject inadequate offers and wait for fair compensation.

When you’re not facing eviction, vehicle repossession, or utility shutoffs, your attorney can negotiate from a position of strength rather than desperation. This breathing room often translates to significantly higher settlement amounts that properly reflect your injuries and losses.

Understanding Non-Recourse Funding

Non-recourse means you only repay the funding if your case succeeds. If you lose, you owe nothing. This structure protects you from additional financial risk while providing you with the resources to fight for maximum compensation.

The funding company assumes all risk, which is why they carefully evaluate each case before approval.

Other States That We Serve

Legal Landscape in Riverside That Affects Funding

Fault Laws

California operates under a pure comparative negligence system, as established in Li v. Yellow Cab Co. (1975). This means you can recover damages even if you’re partially at fault for the accident (your compensation gets reduced by your percentage of fault).

If you’re 30% responsible for a collision, you’ll receive 70% of your total damages. This system impacts lawsuit funding because partial fault doesn’t eliminate your case, though it may reduce the advance amount based on your expected net recovery.

Statute of Limitations

According to California Code of Civil Procedure Section 335.1, you have two years from the date of injury to file most personal injury lawsuits in Riverside. This deadline is critical for funding eligibility, as cases must be filed and remain active to qualify for pre-settlement advances.

If your statute of limitations is approaching expiration, you need to file your lawsuit before seeking funding. Companies won’t advance money on potential claims that haven’t entered the legal system.

Insurance Minimums

California requires minimum auto insurance coverage of $15,000 per person for bodily injury, $30,000 per accident for multiple injuries, and $5,000 for property damage, as outlined in California Vehicle Code Section 16056.

These minimums significantly affect case valuation. If the at-fault driver carries only minimum coverage and your damages exceed $15,000, you may face challenges recovering full compensation.

Funding companies consider available insurance coverage when determining advance amounts for Riverside personal injury cases.

Restrictions or Limitations

California law prohibits pre-settlement funding in certain case types, including family law matters, class actions in which the plaintiff is not a named party, and criminal matters.

Additionally, California Business and Professions Code Section 6154.5 requires specific consumer protections and disclosures for legal funding transactions, which affects how quickly some applications can be processed in Riverside.

Lawsuit Funding Availability in California (CA)

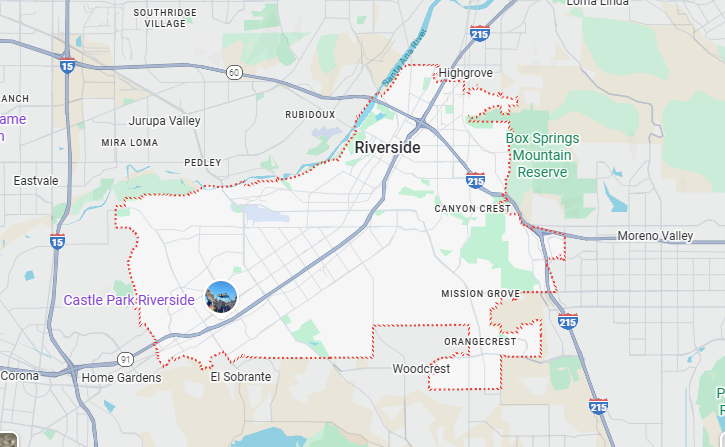

Tribeca offers legal funding statewide, including the following cities and towns near you:Benefits of Choosing Tribeca Lawsuit Loans in Riverside

Tribeca provides lawsuit funding designed specifically for plaintiffs facing financial hardship during litigation. You’ll receive your funds within 24 hours of approval, giving you immediate access to money when you need it most.

Key advantages include:

- No credit check or employment verification required. Your case strength determines approval, not your financial history

- Simple interest rates instead of compound interest, which keeps your repayment amount more manageable as your case progresses

- Non-recourse funding means you owe nothing if your case doesn’t succeed, protecting you from additional financial risk

- Direct coordination with your attorney to ensure all California legal requirements are met for Riverside pre-settlement funding

- Flexible funding amounts up to $2 million based on your expected settlement value and case specifics

- No upfront fees or hidden charges; you only pay when your case settles successfully

Our application process takes minutes to complete, and our team handles all communication with your legal counsel to expedite approval and funding. Apply today or call 866-388-2288 for more information.

Can I Get More than One Pre-Settlement Loan for My Case in Riverside?

Yes, you can get multiple pre-settlement loans for your Riverside case if there’s enough remaining settlement value to support additional funding. This is called “stacking.” Lenders will approve a second advance only if your attorney confirms your expected settlement can cover both loans, plus interest and attorney fees.

However, each loan accrues its own interest, which can significantly reduce your final payout. Before stacking loans, calculate carefully.

Multiple advances over a long case timeline could leave you with little to nothing after all repayments if your settlement comes in lower than expected.

Frequently Asked Questions About Lawsuit Loans in Riverside

How fast can I receive funding in Riverside?

Once your application is approved and your attorney provides the necessary documentation, we transfer funds within 24 hours. Most Riverside residents receive money in their bank accounts the next business day, allowing them to address urgent financial needs immediately.

Does my credit score matter?

No. Legal funding is based entirely on your case’s merit and expected settlement value. We don’t run credit checks or consider your credit history, current debts, or employment status when evaluating your personal injury loan application in Riverside.

What happens if I lose my case?

You owe absolutely nothing. Non-recourse funding means the advance is only repaid from your settlement or jury award. If you don’t recover compensation, you keep the money we provided and have no repayment obligation whatsoever.

Is this a loan or an advance?

It’s technically a non-recourse cash advance against your future settlement, not a traditional loan. This distinction matters because it eliminates personal liability. The funding is secured only by your case proceeds, not by you personally or your assets.

Can I request additional funding later?

Yes. If your case takes longer than expected or your financial needs increase, you can apply for additional funding on the same case. We’ll reassess your case value and expected timeline to determine if additional advances are appropriate for your situation.

How does repayment work?

When your case settles, or you win at trial, your attorney receives the settlement check and pays Tribeca directly before disbursing your portion. The repayment includes the original advance plus agreed-upon fees and interest. You never make payments out of pocket. Everything is handled through your attorney at case resolution.

Does this impact my relationship with my attorney?

No. Your attorney’s job is to maximize your compensation regardless of whether you have lawsuit funding. In fact, funding often improves case outcomes because your lawyer can reject inadequate settlement offers and take the time needed to build the strongest case possible without pressure from your financial stress.

Are all injuries eligible for funding in Riverside?

Most personal injury cases qualify, but some limitations apply. We handle auto accidents, slip-and-fall injuries, medical malpractice, wrongful death, product liability, and workers’ compensation cases. We don’t provide funding for family law matters, criminal cases, or class actions in which you’re not a named plaintiff, as required by California law.

Get Started Today

Fill out the form for a free consultation and quote. Get cash as soon as 24 hours of approval."*" indicates required fields