Bakersfield Lawsuit Loans

Get Cash While Your Case SettlesIf you're a Bakersfield plaintiff waiting on a personal injury settlement or another type of claim, a California lawsuit loan is a vital financial lifeline. At Tribeca, we offer quick, no-risk legal funding to assist plaintiffs, reduce financial pressure, and support legal cases without out-of-pocket expenses.

Our non-recourse cash advances enable plaintiffs to pursue fair compensation with confidence.

- Repay $0 If You Lose

- Get Cash In 48 Hours

- Lowest Rate

- Repay $0 If You Lose

- No Credit Check

- 24hr Funding

How to Apply for Pre-Settlement Funding in Bakersfield, CA

Waiting for a settlement shouldn’t mean putting your life on hold. At Tribeca, we’ve streamlined the process to provide financial relief and offer fast approval when you need it most.

Our simple 3-step process gets you the cash you need, without added stress.

-

1

Call Us or Apply Online

Start your application online or call us toll-free at 866-388-2288. Just share basic case details and your attorney’s contact information. No credit checks, no upfront fees, and no risks.

-

2

Case Review Process

We’ll connect with your lawyer to assess your claim’s strength and estimated settlement amount. This step helps us secure case-related expenses with no cost or hassle on your end.

-

3

Receive Funding

If approved, you can receive quick funding in as little as 24 hours, giving you the breathing room to manage legal costs right away.

Types of Cases We Fund in Bakersfield, California

Whether you're facing a personal injury, workplace accident, or civil dispute, Tribeca provides lawsuit loans in Bakersfield to ease financial burdens and support legal representation. We offer legal funding for these case types:Bakersfield: Eligibility and Qualifications for Lawsuit Loans

Not everyone will qualify for a lawsuit loan; however, if your case is active and supported by a strong legal team, you may be eligible. Unlike banks, we don’t ask for your credit score, income, or employment status.

At Tribeca, we focus on the strength of your legal claim, ensuring responsible funding for plaintiffs with solid cases and real settlement potential.

To qualify for pre-settlement funding in Bakersfield, you’ll need:

- An Active Lawsuit filed and progressing in a U.S. court

- Legal Representation from a contingency-based attorney

- A Strong Case with a high chance of reaching a favorable settlement

Apply Today

"*" indicates required fields

Bakersfield: Why Choose Litigation Funding from Tribeca

Fast & Simple Process

No credit checks, upfront fees, or hidden costs

Rapid Funding

Get $500 to $1,000,000 within 24 hours of approval

Risk-Free Support

No repayment unless you win your case

Fair & Transparent Rates

Competitive, non-compounding fees

Trusted Reputation

100,000+ clients served, 25+ years in business, A+ BBB ratingWhat Our Clients Say

Overview of Lawsuit Settlement Loans in Bakersfield, CA

In Bakersfield and across California, lawsuit settlement loans are considered non-recourse, meaning they’re only repaid if you win your case. This protects Bakersfield plaintiffs from personal financial risk, a core principle of Tribeca’s no-risk legal funding model.

While California currently has no strict regulations on legal funding, proposed bill Assembly Bill 931 aims to introduce fee caps, disclosures, and consumer protections.

What You Should Know About Lawsuit Loans in California:

| Average Tribeca Funding Per Case | Tribeca can provide anywhere from $500 to $2 million in funding |

| Average CA Pre-settlement Funding | 7% to 10% of the estimated value of the case |

| Fault Laws in California | Pure Comparative Negligence, which means the plaintiff’s compensation is reduced by their % of fault. |

| Statute of Limitations in California | Personal Injury: 2 years from the injury date

Property Damage: 3 years from the date the damage occurred |

| Minimum CA Auto Liability Coverage | Bodily Injury: $30,000 per person

Bodily Injury: $60,000 for more than one person Property Damage: $15,000 |

| Minimum CA Uninsured/Underinsured Motorist (UIM) Liability Coverage | Bodily Injury: $30,000 per person

Property Damage: $3,500 |

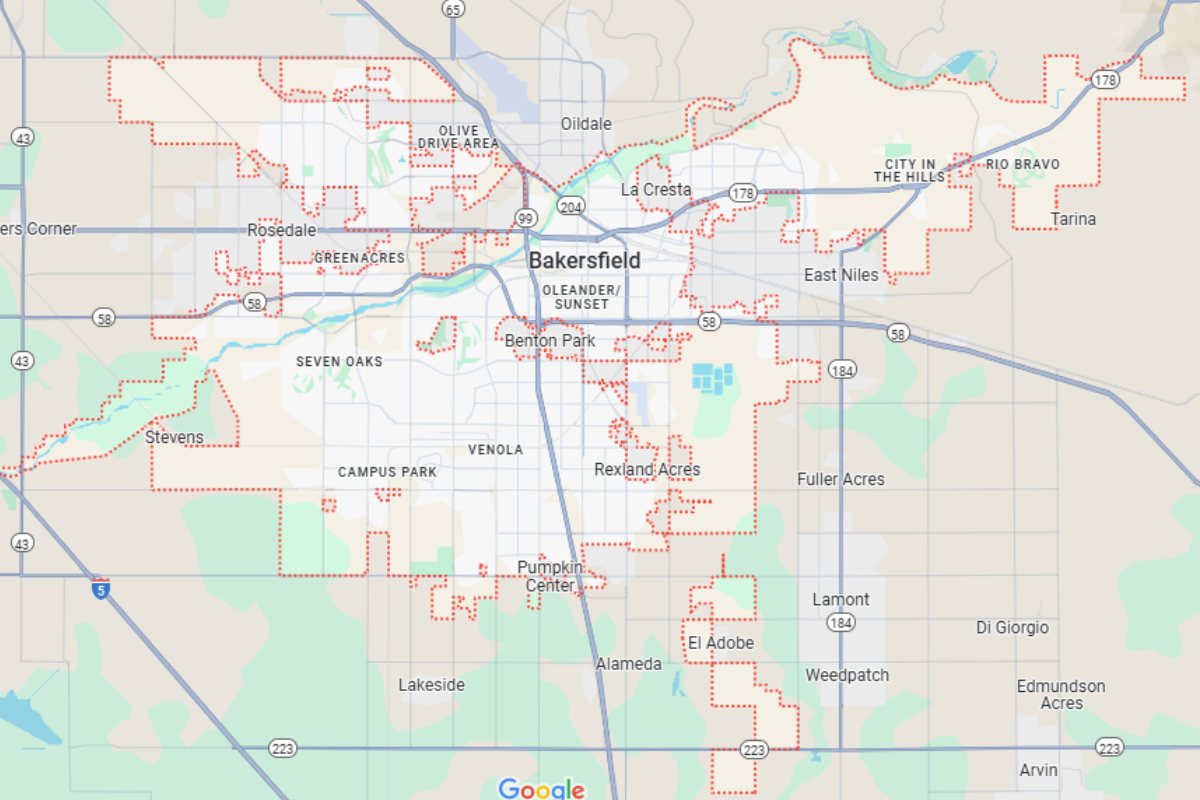

Lawsuit Funding Availability in California (CA)

Tribeca offers legal funding statewide, including the following cities and towns near you:Bakersfield: How Lawsuit Loans Help Avoid Premature Settlements

When bills are piling up and income has stopped, it’s tempting to accept the first settlement offer, even if it’s far less than you deserve. That’s where Tribeca’s no-risk settlement loans can make all the difference.

Our funding gives Bakersfield plaintiffs the financial breathing room to help with living expenses and avoid out-of-pocket costs. With the pressure off, your attorney has the time to negotiate better settlement advances, and improve case outcomes.

Get Lawsuit Funding in These States

How Does the Typical Timeline for a Personal Injury Settlement in Bakersfield Influence the Cost of a Lawsuit Loan?

The longer a personal injury case takes to settle in Bakersfield, often 1 to 3 years, the more interest accumulates on a lawsuit loan. With monthly compounding rates, extended timelines can nearly triple repayment amounts. Plaintiffs should weigh this carefully and choose funding that aligns with their expected case duration and settlement value.

Get Funds in 24 Hours

If you’re a Bakersfield plaintiff facing financial pressure, help is just a phone call away. Tribeca makes it easy with a free, no-obligation application, minimal paperwork, and fast approval, often in under 24 hours. No credit checks. No upfront costs. Just the support you need when you need it most. Apply now online or call 866-388-2288 to speak with a Bakersfield funding specialist today. Apply NowGet Started Today

Fill out the form for a free consultation and quote. Get cash as soon as 24 hours of approval."*" indicates required fields