San Jose, CA Lawsuit Loans

Get Cash While Your Case SettlesIn San Jose, personal injury cases take months or even years to settle. California lawsuit loans enable quick access to lawsuit funds, helping to cover litigation expenses, medical bills, and other pressing financial needs while waiting for fair compensation.

At Tribeca Lawsuit Loans, we provide non-recourse loan options, which means that you only repay if you win your case.

- Repay $0 If You Lose

- Get Cash In 48 Hours

- Lowest Rate

- Repay $0 If You Lose

- No Credit Check

- 24hr Funding

How to Apply for Lawsuit Funding in San Jose, CA

Tribeca Lawsuit Loans makes it easy for plaintiffs to secure legal funding, providing immediate financial relief to those who need it. No credit checks or employment verification required.

-

1

Fill Out Our Application Form

Complete our online application form with your case details and financial needs, or call 866-388-2288 for immediate assistance.

-

2

Wait for Loan Approval

Our team will contact your attorney to assess the strength of your case and determine the funding amount you qualify for.

-

3

Receive Lawsuit Funding

Upon approval, receive funds ranging from $500 to $1 million directly into your bank account, typically within 24 hours.

San Jose: Why Choose Legal Funding from Tribeca

Fast Funding

Receive your settlement loan in as little as 24 hours.

No Credit Check:

We base approval solely on your case, not your credit score.

Non-Recourse Loans:

If you lose your case, you owe us nothing.

Flexible Terms:

We offer tailored repayment schedules to fit your needsOur Satisfied Clients

San Jose: Qualifying for Lawsuit Funding

Eligibility for lawsuit funding in San Jose is based on the strength of your legal claim rather than your financial history.

You’ll have a high chance of getting approved if you meet the following criteria:

- Pending Legal Case: Have an active lawsuit underway.

- Legal Representation: Be represented by a qualified attorney or legal counsel.

- Transparency: Be able to provide honest details during the application process.

- Evidence of Liability: Have medical records, legal filings, and proof of liability.

- Viable Case: Have a high chance of success, supported by evidence.

At Tribeca Lawsuit Loans, we allow loans without credit checks because our settlement loans are not considered traditional loans. Instead, they are cash advances against the expected settlement of your case.

Apply Today

"*" indicates required fields

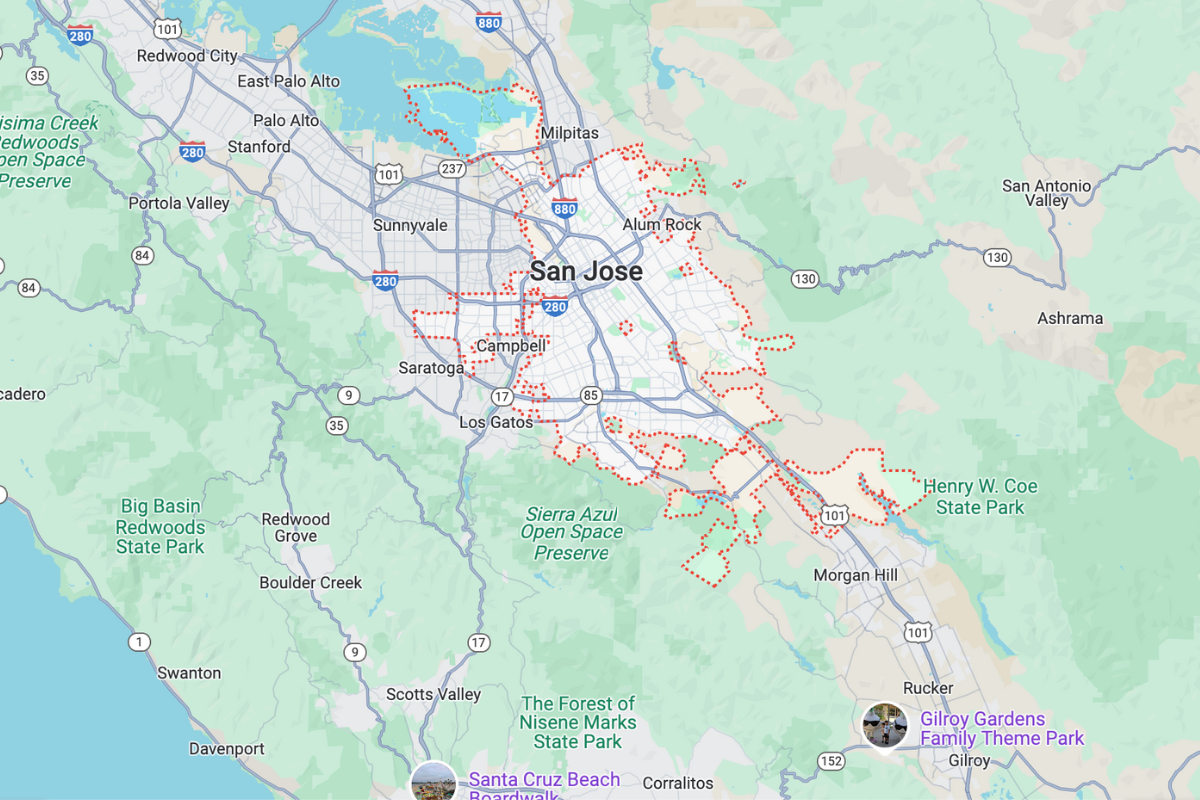

Lawsuit Funding Availability in California (CA)

Tribeca offers legal funding statewide, including the following cities and towns near you:Avoid Settling Prematurely with Our Lawsuit Funding

Many plaintiffs in San Jose feel pressured to settle their lawsuit early due to financial strain. Settlement loans offer the financial flexibility to wait for fair compensation.

More than that, the non-recourse nature of lawsuit funding reassures you that you aren’t burdened with debt if you lose your case. This ensures that there is no personal financial risk on your end.

Get Lawsuit Funding in These States

Quick Reference Guide to Lawsuit Loans in San Jose

San Jose falls under the jurisdiction of California, following a pure comparative negligence rule. Under this rule, your compensation is reduced to the percentage of your fault.

The pre-settlement funding amount you get will be based on a portion of the estimated settlement amount. For Tribeca Lawsuit Loans, legal funding rates may be as follows:

- Average Funding Amount: $500 to $1,000,000, depending on your case

- Interest Rates: Typically 2% to 4% per month after winning the case

Note: Lawsuit funding is currently not regulated by law; however, consumer protection laws, such as the California Unfair Competition Law and the California Consumers Legal Remedies Act, still apply.

As of the time of writing, Assembly Bill 743 (AB 743) may soon be able to regulate lawsuit financing within California, provided it passes through the legislative process and is signed into law.

Tribeca Lawsuit Loans ensures that we remain fully compliant with California’s consumer protection laws and are committed to providing transparent, responsible lending practices to all San Jose plaintiffs.

What to Expect When You File a Lawsuit

In San Jose, personal injury cases are primarily handled by the Santa Clara County Superior Court. Common cases include car accidents, slips and falls, and medical malpractice. The statute of limitations for personal injury claims in California is 2 years from the date of the injury, as outlined in California Code of Civil Procedure Section 335.1, so make sure to file your case on time.

Apply for Lawsuit Funding in San Jose Today

Struggling with medical bills, legal fees, or other expenses during your case? If you’re in San Jose and need immediate financial assistance, Tribeca Lawsuit Loans can support financial stability during litigation. Request a quote today to learn how much pre-settlement funding you can qualify for. Call us at 866-388-2288 or complete our simple online application form to start the process. Get Funded TodayGet Started Today

Fill out the form for a free consultation and quote. Get cash as soon as 24 hours of approval."*" indicates required fields