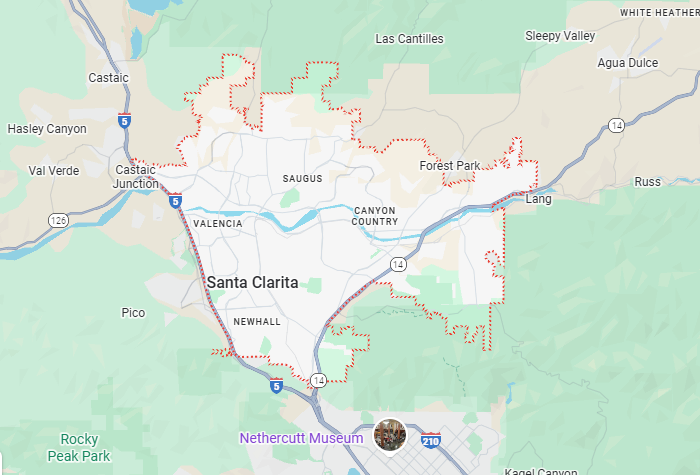

Lawsuit Loans in Santa Clarita, CA

Get Cash While Your Case SettlesLawsuit loans in Santa Clarita give personal injury plaintiffs the financial breathing room they need while pursuing fair compensation.

If you're facing mounting medical bills or everyday expenses during litigation, California lawsuit loans can help you cover essential costs without the pressure of immediate repayment.

- Repay $0 If You Lose

- Get Cash In 48 Hours

- Lowest Rate

- Repay $0 If You Lose

- No Credit Check

- 24hr Funding

What a Tribeca Lawsuit Loan in Santa Clarita Can Help You With

Living Expenses

Rent, mortgage payments, and utility bills don’t stop during your case. Santa Clarita pre-settlement funding helps you maintain stability while your attorney fights for the settlement you deserve.

Medical Costs

Ongoing treatment, physical therapy, and prescription medications add up quickly. Legal funding in Santa Clarita ensures you can continue necessary care without depleting your savings.

Debt Management

Mounting credit card balances and overdue bills add to the stress. A personal injury loan in Santa Clarita prevents debt from derailing your financial recovery.

Strategic Legal Advantage

With funding in place, you can reject lowball settlement offers and give your attorney time to build the strongest possible case.

How to Apply for a Lawsuit Loan in Santa Clarita

Applying for legal funding through Tribeca is simple and fast. Our process is designed to help you get the support you need quickly while ensuring compliance with Santa Clarita’s specific regulations.

-

1

Fill Out an Application

Just fill out the form and provide your case details. No credit check is required, which means you can apply without worrying about your credit history.

-

2

Review Your Case

Tribeca reviews your application to ensure compliance with California laws. We coordinate with your legal counsel to verify case details and settlement potential.

-

3

Get Approved & Funded

Once approved, we’ll send over your pre-settlement funding within 24 hours to cover medical bills, legal fees, or other essential costs without delay.

Do You Qualify for a Lawsuit Loan in Santa Clarita?

Active Personal Injury Lawsuit

You must have a pending case with another party responsible for your injury. These are advances against your anticipated settlement.

Legal Representation

A qualified attorney must represent you throughout the litigation process.

Strong Case Merit

Your lawsuit should have a high likelihood of success, supported by medical records, accident reports, and proof of liability.

Transparent Communication

Honest disclosure of your case details during the application ensures faster approval and an appropriate funding amount.

Apply Today

"*" indicates required fields

Avoid Premature Settlements in Santa Clarita

Financial Breathing Room

When bills pile up, accepting the first settlement offer feels tempting. Lawsuit funding gives you the financial cushion to wait for fair compensation rather than settling out of desperation.

Non-Recourse Protection

This is non-recourse funding, meaning you only repay if you win your case. If your case doesn’t result in a settlement, you owe nothing back.

Stronger Negotiating Position

With immediate financial pressure relieved, your attorney can negotiate from a position of strength rather than necessity, often resulting in significantly higher settlement amounts.

Get Lawsuit Funding in These States

Legal Landscape in Santa Clarita That Affects Funding

Fault Laws

California follows pure comparative negligence under California Civil Code 1714. You can recover damages, even if partially at fault, though your compensation is reduced by your fault percentage, which affects funding amounts.

Statute of Limitations

You have two years from the injury to file under California Code of Civil Procedure § 335.1. Cases must be filed and active to qualify for pre-settlement funding in Santa Clarita.

Insurance Minimums

California requires a minimum auto insurance of $15,000 per person, $30,000 per accident for bodily injury, and $5,000 for property damage (Vehicle Code § 16056). Low minimums often limit settlement values and funding amounts.

Restrictions or Limitations

California prohibits funding for employment disputes, family law, criminal cases, and certain class actions. Business and Professions Code § 6154.5 requires specific consumer protections for legal funding transactions in Santa Clarita.

Lawsuit Funding Availability in California (CA)

Tribeca offers legal funding statewide, including the following cities and towns near you:Benefits of Choosing Tribeca Lawsuit Loans in Santa Clarita

Santa Clarita lawsuit cash advance funding provides immediate financial relief without the constraints of traditional loans.

You receive funds within 24 hours of approval, with no credit check or employment verification required. The non-recourse structure means zero repayment risk if your case doesn’t succeed.

Our simple application process works directly with your attorney to evaluate your case’s strength, giving you access to up to $2M in funds while maintaining full control over your legal strategy and settlement decisions.

Get funded today. Apply online or call 866-388-2288 to get started.

What Are the Eligibility Requirements for Lawsuit Loans in Santa Clarita?

To qualify for a lawsuit loan in Santa Clarita, you need an active personal injury lawsuit represented by an attorney, with strong liability and sufficient expected damages.

Your personal finances, credit score, and employment don’t matter. Funding companies only evaluate your case strength, not your financial history.

Frequently Asked Questions About Lawsuit Loans in Santa Clarita

How fast can I receive funding in Santa Clarita?

Most approved applicants receive funds within 24 hours. The speed depends on how quickly your attorney provides case documentation.

Does my credit score matter?

No. Litigation funding approval is based entirely on your case merit and settlement potential, not your credit history or financial status.

What happens if I lose my case?

You owe nothing. This is non-recourse funding, so Tribeca absorbs the loss if your case doesn’t result in compensation.

How does repayment work?

Repayment comes directly from your settlement proceeds. Your attorney deducts the amount owed to Tribeca before releasing your portion of the settlement.

Can I request additional funding later?

Yes. If your case extends longer than expected or additional expenses arise, you can apply for supplemental funding on the same case.

Get Started Today

Fill out the form for a free consultation and quote. Get cash as soon as 24 hours of approval."*" indicates required fields